- Aicpa generally accepted auditing standards professional#

- Aicpa generally accepted auditing standards free#

Secondly, there was underestimation of e-commerce state tax payment provided by the employees. First, the auditors discovered that lease on technology asserts were significantly inflated. Furthermore, the audit also included the assessment of the effectiveness of accounting principles used by the corporation and overall financial statement presentation.īased on the accounting principles stated by Generally Accepted Auditing Standards (GAAP) the auditors suspected possible fraud in the corporation.

The audit team objectively evaluated all the evidence with a mindset that acknowledged fraud might be present regardless of the past relationship with the corporation.

Aicpa generally accepted auditing standards professional#

In addition, the team conducted the audit with an attitude of professional skepticism and due professional care.

Aicpa generally accepted auditing standards free#

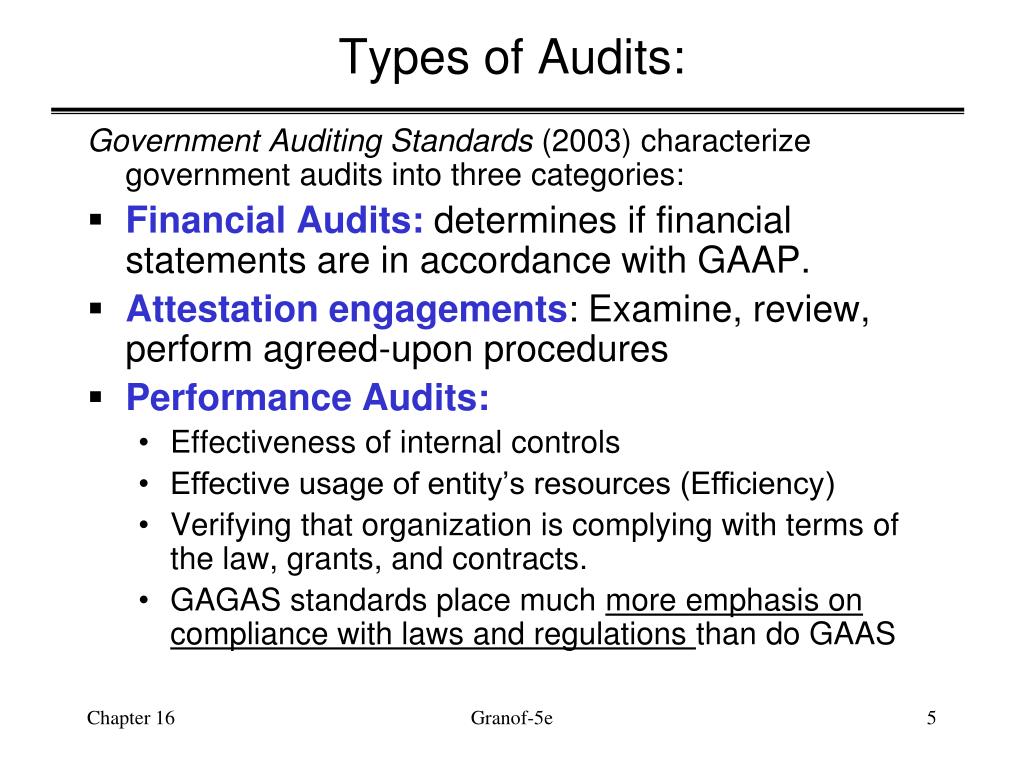

Secondly, the team planned and performed an audit, which responded to the identified risks and whether the financial statements were free from material misstatements, whether caused by fraud or human error. First, the auditors assessed the risk of fraud in every audit, both misappropriation of asserts and fraudulently financial reporting, in order to detect in causes of fraud. The primary objective of the audit was to provide reasonable assurance that the financial statements of the corporation were fairly represented according to the Generally Accepted Auditing Standards. The audit was conducted in accordance with the standards of the Public Companies Accounting Oversight Board. Having been selected as one of several accountants on a team of autonomous auditors by a new CFO, the team evaluated the corporation’s accounting practices. Propose recommendation on how an organization can reduce fraudulent activities. In addition, the study will explore and explain the effect of fraud in an organization and its operation. The purpose of this study is to evaluate the effectiveness of the Generally Accepted Auditing Standards in an organization. In addition, the GAAP is not a single rule, but a combination of several principles that can govern transaction of businesses. Generally Accepted Auditing Standards provide general guidelines for organizations and CPA firms on how they can present and prepare their business financial statements, income and expense statements and assert and liabilities report.

For standardization purpose, the America Institute of Certified Public Accountants (AICPA) came up with set of rules known as the Generally Accepted Auditing Standards. This trend has worried most managers forcing them to look for external auditors to verify their daily transactions. The annual report of the Association of Certified Fraud Examiners (ACFE 2006) estimates that organizations lose up to 5% of their revenue to fraud related activities. Globalization and technological advance have further made the situation to become complex, as auditors have to compete with knowledgeable and well equipped fraudsters. In today’s tumultuous and multifarious economic environment, the level of fraud has drastically increased in many organizations.

0 kommentar(er)

0 kommentar(er)